Insurance

Long Term Two-wheeler Insurance: Why it’s worth considering

Muktha Tavane|2 min read|28 December, 2021

A Long Term Two-wheeler Insurance plan is like your one-year DTH or broadband plan where you can pay a few of the recurring payments in one shot to make things easy while you enjoy benefits and discounts offered by your provider.

If you’re that person who prefers making advance payments, consider a Long Term Two-wheeler Insurance plan. Here’s all you need to know about the Insurance type to know if it’s right for you:

What is a Long Term Two-wheeler Insurance plan?

A Long Term Two-wheeler Insurance plan offers protection against damages or loss caused to your two wheeler — much like a standard one-year Two wheeler Insurance plan. The difference in a Long Term plan is the term of the policy which is typically 2–3 years.

Thus, by paying the premium for 2–3 years upfront, you can enjoy seamless protection for your bike and do away with the need to renew every year.

Why you should consider Long Term Two-wheeler Insurance plan

Take a look at these advantages of Long Term Two-wheeler Insurance to take a call on your next Bike Insurance purchase.

1. Potential premium savings up to 20–40% upfront

The Insurance Regulatory and Development Authority of India (IRDAI) may hike the premium for the third-party liability portion of Two-wheeler Insurance by up to 20% every year. When you buy a Long Term plan, you can potentially save on 2 hikes for the third-party premium along with the service tax as well.

2. Get benefits with No-claim Bonus even after a claim

The No-claim Bonus offered in a standard one-year Two-wheeler Insurance policy becomes nil once a claim is made. In the case of Long Term Two-wheeler Insurance policies, the bonus is reduced and does not become nil. For instance, if the NCB applicable at the time of purchase of a 3-year policy is 35% and a claim is made in the second policy year, the NCB for that year gets reduced to 20%, and not 0% as is the case in a single-year policy.

3. Stay protected and stress-free

Once you buy a Long Term plan, financial protection of your vehicle is guaranteed for 2–3 whole years. If a one-year policy is not renewed and lapses even for a single day, it could prove to be risky and in the event of an unfortunate accident during the period, no claims will be honoured by the Insurer. With a multi-year Insurance plan, you can ride worry-free with no fears around financial liability arising due to an unforeseen event.

4. Cancel your policy and get a premium refund after a claim

In case you wish to cancel your policy after you have made a claim, you can do so and get a refund on the premium applicable on the unexpired years. In a single-year plan, on the other hand, if you make a claim, you are not eligible for any premium refund when cancelling the policy.

The cancellation terms and conditions vary from one insurer to another and need to be reviewed at the time of policy purchase.

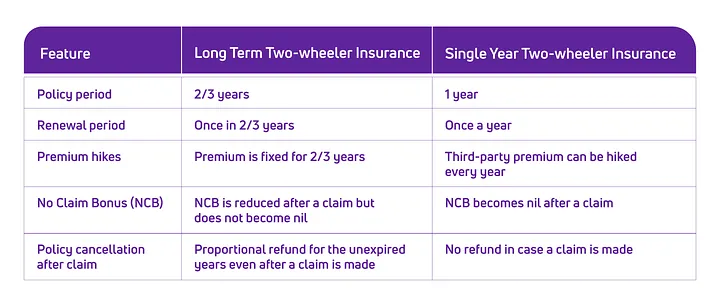

Long Term vs Single Year Two-wheeler Insurance

Here is a snapshot of the comparison between Long Term and Single Year Two-wheeler Insurance plans:

Thus, with a Long Term Two-wheeler Insurance plan, you can carry a single policy document for a two or three-year tenure and ride your two wheeler knowing you have covered it with Insurance for a considerable amount of time.