Pulse Bytes

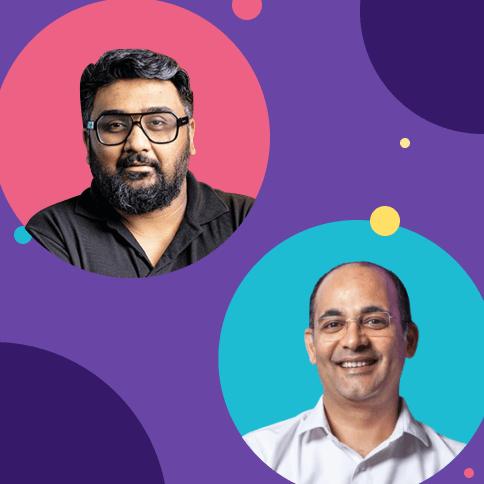

Fintech Month: Fireside Chat with Kunal Shah and Sameer Nigam

Sampurna Mitra|3 min read|07 March, 2022

The FinTech month was kickstarted with an exciting fireside conversation between Kunal Shah (Founder, CRED) and Sameer Nigam (Founder & CEO, PhonePe).

The core theme of the conversation was “The Future of FinTech” and how technology disruption has become the talk of the town in today’s cashless age! Kunal started by focusing on the fact that in today’s times, everything from getting food delivered to our doorsteps, booking vaccination appointments online to tracking our loved ones’ whereabouts, technology has seamlessly integrated into people’s lives. He emphasised that what COVID has ensured is that every single business in today’s times becomes a tech business and we are gradually entering a world that is leaning more towards technology and doing things digitally.

This inclination towards technology was triggered by the pandemic and the need to go online to meet one’s daily needs. This behaviour has permeated to more people for two specific reasons. The first reason is that it is significantly more efficient and less time-consuming and the second reason is that the younger generation is slowly inclining more and more towards text-based chats instead of conversations on phones.

The Future of FinTech

Talking about what the future holds for FinTech, Kunal highlighted that when it comes to depositing money, he would place his trust in decade-old or century-old institutes, whereas when it comes to borrowing, he would always go with the more convenient option. For example, in terms of withdrawing money from an ATM, one would always prefer to do so from the nearest ATM machine regardless of which bank it is.

The same theory applies to purchasing any product in the market. People are always looking for the most straightforward way of getting things done. Whether it is online shopping, booking a cab or purchasing insurance, people will place their trust in products that are easily available online instead of purchasing something that needs convincing.

Emerging spaces such as cryptocurrency are gaining immense popularity. People are now starting to consider things such as crypto regulations, which is an indicator of the changing behavioural pattern of consumers. They are adapting to these new scenarios way more effectively making way for them to be more efficient.

Kunal concludes by saying that the future of FinTech, more than product innovation, relies massively on human values. Values are what will pave the road for the future!

Disrupting Technology Barriers

Sameer brought into focus the role that COVID has played in the recent disruption of technology and in breaking down barriers.

Technology barriers have been blown away in the last couple of years with information becoming more and more accessible. This is followed by industries relying more on the data at hand to come up with strategies for the future to satisfy consumer needs. With things going digital, in today’s date, getting access to any information has become super seamless, thanks to regulators who have played a major role in providing access to said information.

Highlighting the importance of using the available information, Sameer further added that analysing the information at hand is crucial to understanding product trends and determining what works best for the company. Startups these days are also following the same mantra, thereby revolutionising the way ecosystems are shaped in today’s day and age.

The Road Ahead for Startups and Entrepreneurs

Kunal elucidated that market fluctuations have happened in the past and can also be expected in the future. He explained that this time period could be considered to be less distractive for investors as there wouldn’t be too much capital to be sloshed around.

He lists down two things that people should be mindful of in this time period.

- CEOs and founders of companies should have enough runway to recover from such cycles. A runway of three years is ideal in his opinion.

- A downward market trend requires one to build on available assets since there is less inflow of money. This is the time for hustling and companies should make the most of it.

Sameer highlighted that the availability of capital and the knowledge that digital is the future is what is fueling the functionalities of many startups in today’s times. Increasingly passionate entrepreneurs are entering the FinTech space and even though catering to a population as large as India is quite the challenge, there is a growth of competitive players in the market.

Sameer concluded the session with the following key takeaways for startups:

- Build a company that is solution-oriented. If one is solving problems, financial support typically follows suit.

- There is a lot of capital in the market, entrepreneurs just have to go out there and grab the opportunity with their products.